A recent survey of more than 300 adults in the United States and Puerto Rico shows that online shopping continues to gain popularity among Hispanic consumers, with 63% preferring digital stores over physical locations during this holiday season. This shift in consumer behavior comes despite many respondents carrying significant credit card debt, raising concerns about financial stability during a period traditionally marked by increased spending.

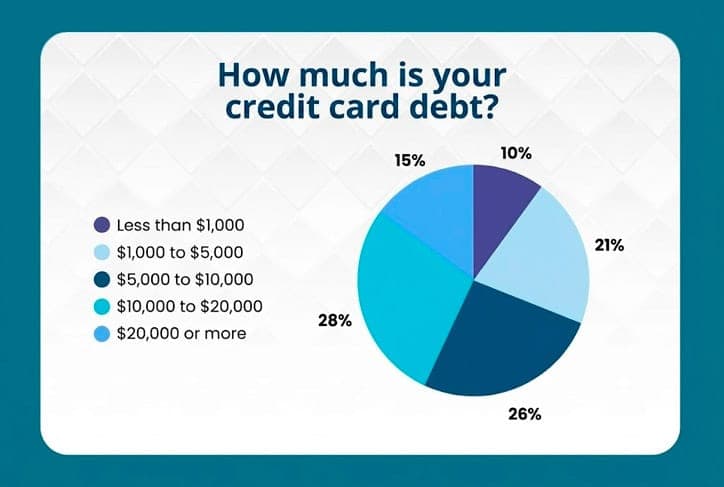

The convenience of online shopping appears to be driving this trend, with 34% of participants shopping online 2 to 3 times per month and 8% making purchases 2 to 3 times per week. Without clear monthly budgets, financial experts warn that these frequent purchases could push household finances beyond sustainable limits. The survey data reveals concerning debt levels among respondents, with many carrying balances that could complicate their financial health.

Despite these financial challenges, most Hispanic consumers plan to maintain holiday spending traditions. The survey found that 44% plan to spend between $100 and $500 on year-end festivities, while 26% will spend between $50 and $100. Another 15% plan to invest between $500 and $1,000, and only 3% anticipate spending more than $1,000. Just 11% of respondents indicated they don't plan to spend anything during the holiday season.

Payment method preferences show debit cards representing 25% of online purchase preferences, while credit cards account for 13%. This reliance on credit concerns financial professionals, particularly given the existing debt burden many consumers carry. Shirley Bolano, a financial journalist expert at Consolidated Credit, explained the risks: "When people don't know their debt-to-income ratio and get carried away by the emotion of discounts, it is very easy to fall into the cycle of debt. Enjoying the holidays is important, but doing so at the expense of your financial peace of mind can turn the celebration into a problem that lasts all year."

The survey reinforces the importance of financial planning as a crucial tool for preventing year-end purchases from becoming a long-term burden. Creating realistic budgets, understanding debt-to-income ratios, and establishing clear spending limits before taking advantage of sales events like Black Friday can determine whether consumers end the year with financial stability or increased debt. For those already struggling with debt management, Consolidated Credit offers free counseling services and educational resources to help consumers regain control of their finances and reduce economic stress.