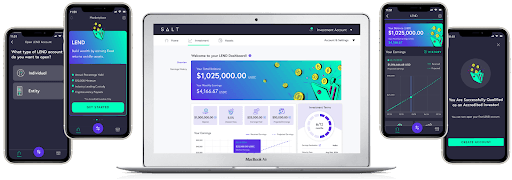

SALT Lending, a crypto-backed financial services provider, has unveiled its SALT LEND Program, offering accredited investors annual returns of up to 10% on USD and stablecoin deposits. This new initiative aims to provide a secure, high-yield alternative to traditional savings accounts, potentially outpacing inflation and offering greater financial control to investors.

The program accepts deposits in USD and stablecoins (USDC, USDT) and will soon offer the option for interest payouts in Bitcoin. This feature combines predictable cash returns with the growth potential of cryptocurrency, allowing investors to potentially grow their savings faster than inflation rates.

Shawn Owen, CEO and Founder of SALT Lending, emphasized the program's role in empowering investors with innovative ways to grow their assets. The LEND Program operates with a focus on security and compliance, utilizing multi-signature processes and partnerships with vetted institutional custody providers to safeguard deposits.

Unlike many crypto yield products that rely on high-risk trading strategies, SALT's LEND Program generates returns exclusively from lending activity providing over-collateralized loans. This approach ensures a lower risk profile for investors, as deposits are used to fund secured loans rather than volatile trading ventures.

The program offers flexible withdrawal options, with funds available after a minimum investment period of 30 days and a maximum holding period of 30 days. This structure provides both liquidity and flexibility for investors.

The introduction of the SALT LEND Program is significant for several reasons. First, it offers a potential solution to the challenge of low-yield savings accounts in the current economic climate. Second, it represents a bridge between traditional finance and the cryptocurrency sector, potentially attracting more mainstream investors to digital assets. Lastly, by offering returns significantly higher than traditional savings accounts, it could pressure conventional financial institutions to reconsider their offerings to remain competitive.

As the program is currently only available to accredited investors, its immediate impact may be limited. However, if successful, it could pave the way for similar products accessible to a broader range of investors, potentially reshaping the landscape of personal savings and investment strategies.